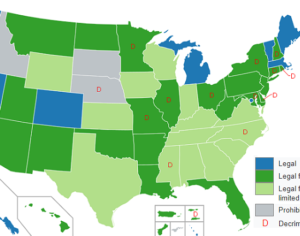

Oregon marijuana: OLCC… certificate of tax compliance rule

The OLCC announced several changes to the tax compliance rule this weekend at the Cannabis & Psychedelic Section of the Oregon Bar Association’s annual conference…

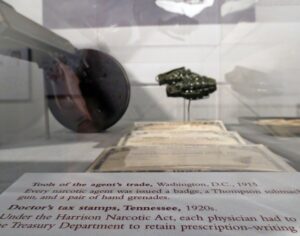

On June 15, 2023, the OLCC approved temporary rules requiring marijuana retailers to obtain a Certificate of Tax Compliance (“Certificate”) from the Oregon Department of Revenue (“DOR”) as a condition for acquiring or renewing a marijuana retailer license, as well as for changes of ownership and adding someone to a license. These new rules resulted from a directive by Governor Kotek following the La Mota scandal that led to the resignation of the Oregon Secretary of State, Shemia Fagan. In short, the temporary rule applied to marijuana retailers, not processors, producers, or wholesalers. The rule mandated that every “applicant” on a license submit a certificate of tax compliance from the Oregon Department of Revenue (“DOR”) at the time of application, or at the time of license renewal, and in connection with certain changes of ownership. The permanent tax compliance rule will not expand to include processors, producers, or wholesalers. This had been a subject of some debate in the past few months. The decision to only require retailers to submit tax compliance certificates makes sense because the problem giving rise to the rule was the non-remittance of sales tax collected at points of sale. In Oregon, such tax is only collected at the retail level. So achieving the goal of timely and full remittance of sales taxes does not require the involvement of non-retail licensees.

Original Article (Harris Bricken):

Oregon marijuana: OLCC announces changes to certificate of tax compliance rule

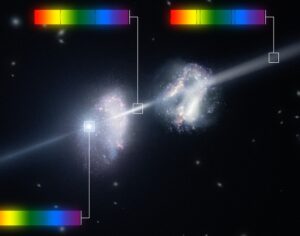

Artwork Fair Use: Apurv013

Recent Comments