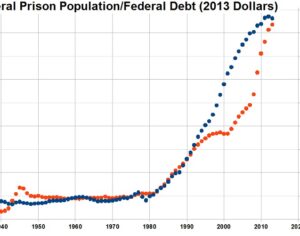

The IRS plans on ramping up audits for cannabis businesses this year…

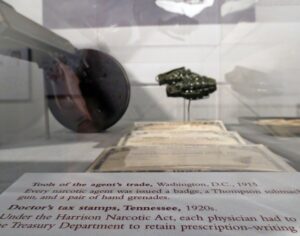

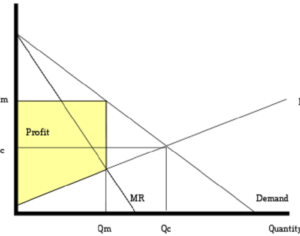

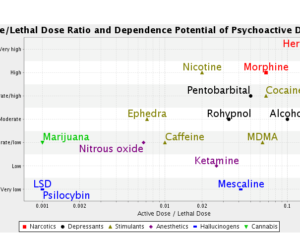

“We’re already dealing with a pretty challenging market environment. And now the IRS is going to be looking for ways to find more tax revenue,” [says Peterson]. So, they created the 280E tax provision, which stipulates that no expenses related to drug trafficking can be written off as legitimate “business expenses.”

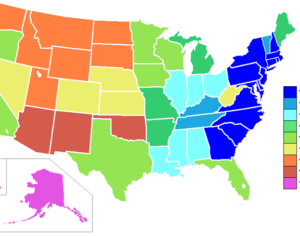

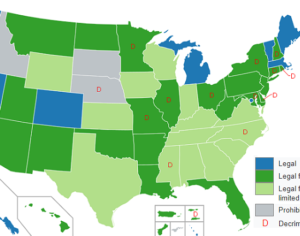

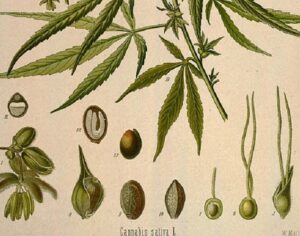

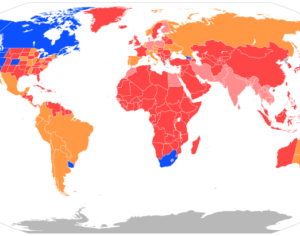

But now, almost forty years later, it’s being used unfairly against the cannabis industry. No cannabis business is allowed to write off business expenses on their taxes because, weed is technically still a schedule I substance. According to the feds, cannabis businesses… (anywhere in the US) are dealing hard drugs and therefore are ineligible for almost any business-related tax expenses. “That is what’s creating these 90-percent tax rates for these companies,” Peterson says. They don’t get to deduct labor expenses, benefit expenses, building costs, insurance lines or even office supplies, he says. “They’re paying 100 percent tax on all of that.”

Original Article (The Rooster):

The IRS plans on ramping up audits for cannabis businesses this year – and many might not survive the cost

Artwork Fair Use: Cannabis Tours

Recent Comments