Oregon’s alcohol producers temporarily stop a 3000% tax hike

…plans to introduce legislation in the next few weeks to track existing alcohol tax revenue to see where it’s being spent.

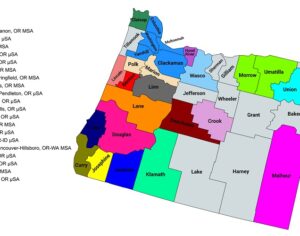

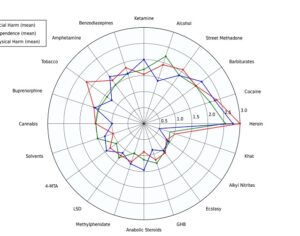

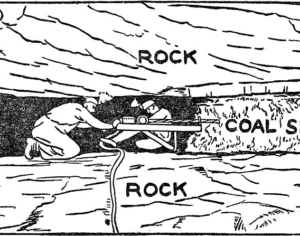

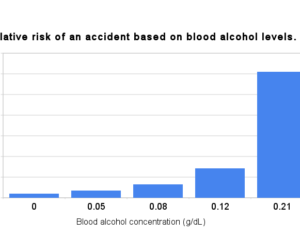

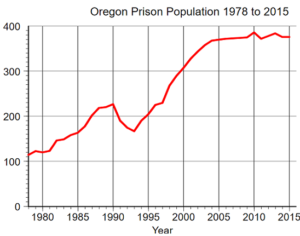

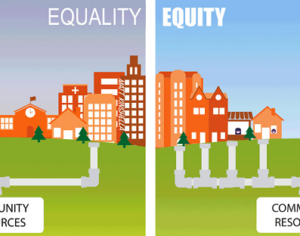

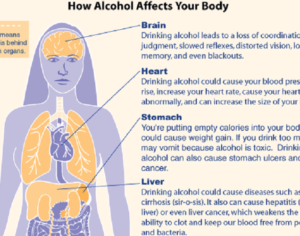

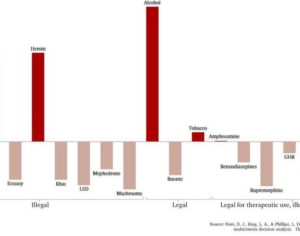

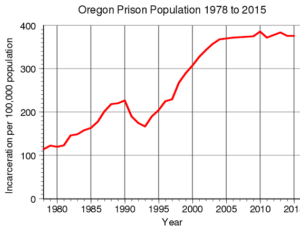

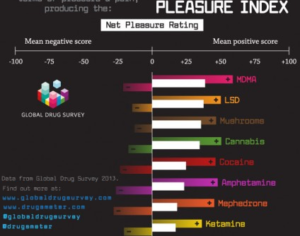

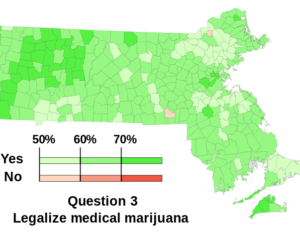

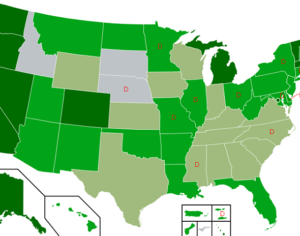

[However],the proposal to increase the business privilege tax on producers and importers of beer and cider from $2.60 to $72.60 per barrel and from $0.65 to $10.65 on every barrel of wine died in the state legislature… OLCC contributed more than $519 million to Oregon programs, cities, and counties in 2017-2019. Of that, more than $260 million went to the General Fund to help pay for programs such as schools, police, and public health programs. Mental health, alcohol, and drug treatment services received more than $18 million, which helps to pay for addiction programs across the state… new research released by the Oregon Health Authority… shows that Oregon’s cost associated with excessive drinking was approximately $4.8 billion in 2019. “To put these costs into context, the $4.8 billion in economic losses stemming from excessive drinking represented roughly 2% of the 2019 gross state product. Averaged across the population, excessive alcohol use cost Oregon $1,100 per person,” the research report explains.

Original Article (Forbes & KATU):

Oregon’s alcohol producers temporarily stop a 3000% tax hike & Oregon beer and wine tax decades overdue, recovery advocates say

Artwork Fair Use: Public domain

Recent Comments